Not everyone wants to be able to resign from their jobs. Some love working, while others don’t. But being financially independent isn’t necessarily about being able to tell your boss what they can put their TPS reports, it’s about being able to weather a financial storm.

For that, at the very least you need a rainy day fund for emergencies. But you might find that once you’ve been able to build a decent rainy day fund, that you’re even more motivated to save and invest more, and then one day you’ll have an investment account so big you’ve got to check it for swimming cartoon ducks. If you’d like that to be you one day then these should be the numbers you focus on:

1. How much debt you have

You will never be financially free if you are paying high-interest rates on debt. NEVER! So track your debt and shrink it to zero as fast as possible. There are no fancy formulas here, just add up all your debt. If it’s a big fat number put it on a crash diet and then when it’s weak and helpless kill it you powerful human you. You’ll be amazed at how good you’ll feel the day you finally pay off the last amount.

Some people like to classify debt. They say there’s good debt and bad debt and encourage you to have good debt, like owning a house or taking a student loan, and they say that credit card debt and short term debt is bad debt and that you should run from it.

I think they’re wrong. There should only be one way to tell if the debt is good or bad, just ask yourself this question: Will I be paying more for something than I should because of the debt?

With a car loan, you often end up paying 1.5 X the value of the car. Of course you might say you need a car to get to work, but you’re actually just lying to yourself. There are so many other options. Why not cycle? Too far? Okay get a cheap scooter, a good one is less than R10 000. If you don’t have that much try the Gautrain, or even Uber until you’ve saved enough.

And if you must have a car with a loan you’re only allowed one car loan for your entire life, on the very first car. Of course, it should be cheap and reliable, and paid off as fast as possible, and from then on, every other car should be bought in cash. Doing just this and nothing else could quite literally give you a $1 million investment account at retirement.

If you’re like most people I speak to, you’ll say that you only have a home loan and that’s good debt because it’s an investment, but again you’re wrong. Your house is not an investment. It’s a very high-risk place you park most of your money with at least a 10% interest rate, while still paying rent to the government and to your body corporate.

At best house prices barely match inflation, but generally when you include all the hidden costs of home-ownership you need to be lucky to break even. And that’s not even mentioning what the coming government fiscal train wreck is doing to the housing market already.

Confession time: I use the 55-day interest-free period on my credit card to earn me an extra R211 a month, that’s good debt! See point 5 here for details.

2. Your savings rate

This was the big number I tracked when I was really getting into building up my investments. Your savings rate is simply the percentage of your income that you can save.

To work it out you simply take the amount you put into your investment account and divide it by the amount of money you make then multiply it by 100 to get a percentage. And remember taxes are not money you make, so you want to use your take-home pay here.

For example, if your take-home pay is R18 000 a month, and you save around R4 500 your calculation would be 4500 / 18000 X 100 = 25%.

The reason I love this number so much is that this one number is enough to predict how long it will take you to reach financial independence, the point where you won’t need to work for money. Yes, it’s your savings rate, not how much you earn that will define your financial well being. Having a high savings rate is the only way to get rich.

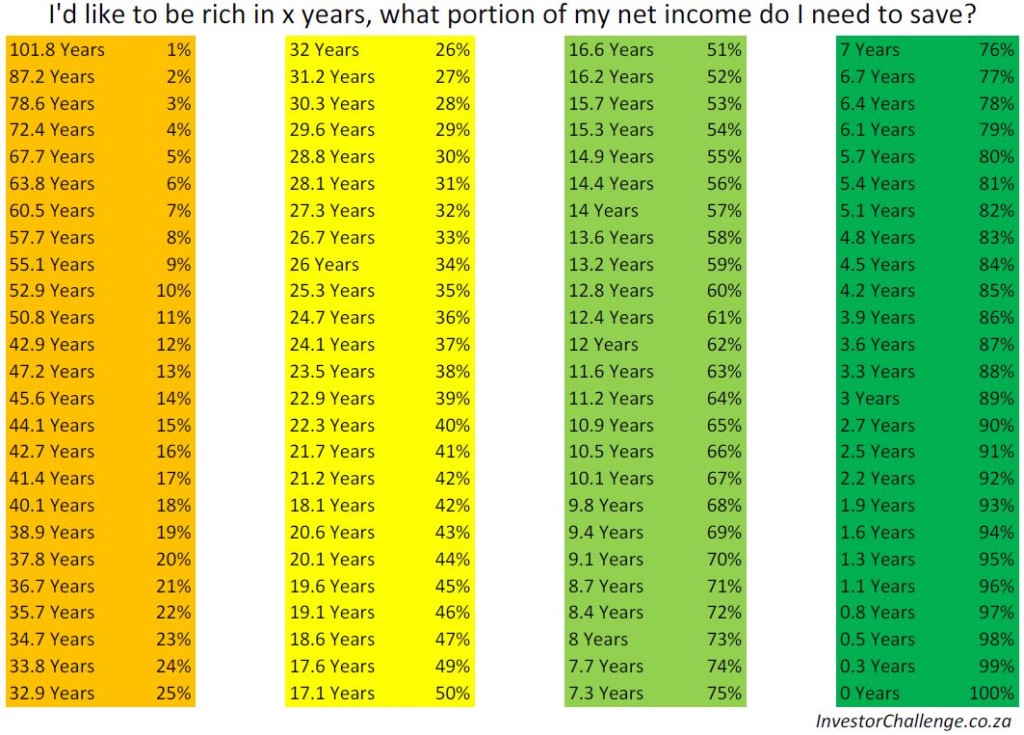

Using the example above, someone saving 25% of their income every month will be rich in 33 years. That was too long for me, so since I started working I put away 50% of my income, and guess what, 17 years later I didn’t have to work. Here’s a table showing how long you’d need to work for each savings rate, aim high!

3. Your annual dividend earnings

I don’t really like to call dividends passive income, because it’s an income stream I worked my ass off to build, but once built the money just keeps rolling in like clockwork.

As I only invest in ETFs this happens 4 times a year, and as I’m still working, I use my dividends to buy more shares meaning I get even more dividends the next year. Then of course, the companies in the ETF also generally earn more money each year, so that grows the dividends even more.

This growth of dividends way outpaces inflation, particularly when re-invested and when you buy more shares with your regular savings too.

For milestones, I like to compare these with some of my expenses:

- In my first year, my dividends paid for my car license renewal.

- The next year it covered my gym membership every month.

- After that, the next milestone was my child’s school fees.

- A few years later it paid for my food, yay I will never starve!

- Next up was minimum wage, my dividends were now a full-time employee working his ass off and giving all his income to me.

- A big milestone for me was my bare-bones budget. This was great, I’d now always have a roof over my head, food to eat and be able to pay school fees!

One caveat here is that you shouldn’t buy shares or ETFs because they pay high rates of dividends. It’s a dangerous strategy which generally leads to lower overall growth. Just keep buying your normal ETFs, ideally the most diversified you can find at the lowest costs possible.

Leave a comment and let me know what dividend milestones you’re aiming for?

4. Your expenses

Earning a fortune won’t make you financially independent. Sure it’s great if you can make it happen, but when someone like Mike Tyson declares bankruptcy after earning over $300 million dollars during his boxing career you can tell that income on its own is not enough.

What impresses me is people who can keep their spending low while living happy, fulfilled lives. Being able to cut costs and keep them low is quite possibly the most important skill you can build with regards to money. And you never know when it’s one you’re going to need.

I get a fair amount of people talking to me about saving and investing. Most of them know exactly how much they spend every month because it’s literally all their income. What they don’t know is where the money goes. It simply vanishes with pretty much nothing to show for it. That’s why when I’m speaking to someone I always recommend they start with just one thing. Figuring out where their money goes each month.

I use an app called 22seven, and I think it’s great. It does all the hard work for you by pulling the information from your bank accounts and putting them into categories, but if you’re a low tech fan just get a notepad and write down what you’re spending on.

5. Super simple % FI formula

Some people like to focus on net worth, but on its own, that’s completely useless. It’s in relation to your expenses where your net worth has real power. Someone with R20 million invested who spends R70 000 a month isn’t financially independent, but someone with R6 million invested who spends R20 000 a month is. That’s why I prefer this formula to see how well you’re doing.

Take the total you’ve got invested, and divide it by 3 X your monthly expenses and read it as a percentage. That’ll tell you what your percentage financially independent is. In the two examples above, the first example would be 20 000 000 / 210 000 = 95%. The second is 6 000 000 / 20 000 = 100%. This formula is based on the 4% rule, or as I prefer to call it, the fantastically simple rule of 300. Now as investments compound you’ll be happy to know that the halfway point isn’t actually 50%, it’s around 30%!

You can also use it to tell how much you’d have to live on if you stopped working right now. If you’re at 75% FI and you lose your job, you could cover 75% of your monthly expenses, so just cut 25% of your expenses and you’re not unemployed any more, you’re retired!