Yes that’s the question folks. What does the average (middle class) South African spend the most money on?

Yes that’s the question folks. What does the average (middle class) South African spend the most money on?

Their house? No but it’s a good guess. Houses are expensive, but this expense can cost you more than your house.

Beer? Boerewors? Biltong? No it’s not one of the 3 B’s either.

The wife? Hopefully not…

Cars? Well done, you’re so smart you could be a traditional governance minister! It is our cars. We spend great big juicy globs of money on cars. As big and juicy as the latest new heavily GMO’d grapefruit sized plums Woolworths recently invented (they’re delicious BTW, go science!).

I’d previously written about how choosing something like an Audi A5 over a Toyota Corolla could end up costing you a million dollars. It seemed to strike a chord, and has been my most read and liked article ever, but now I want to show you how you could be losing out on even more than that with a bad choice in car.

Let’s assume you are an average middle class gainfully employed professional who just bought an entry level manual BMW 318i, and managed to put down a 20% deposit of R100 000, you’d still be left with a monthly payment of around R8573 a month. Now that on it’s own is enough to pay the bond for an R850 000 apartment or small house, but it’s far from the total we can expect to pay for an entry level German car.

In addition to the monthly payment, we also pay for petrol, servicing, tyres, insurance, licensing fees and traffic fines, but there’s one other thing that takes more money than all of those, depreciation.

Thankfully, the AA calculator takes all of that into account. It puts the total cost per kilometer for that embarrassingly small engined 1500cc 3 cylinder German sedan at R7.25 a kilometer. Now if you like most people in South Africa drive around 20 000 kilometers a year, you’ll be spending an additional R12083 a month on your car.

That’s a total of R20656 a month. TWENTY THOUSANDS SIX HUNDRED AND FIFTY AND THREE RAND! Even supposedly intelligent people do this for the majority of their adult life. Are they completely out of our minds? I’ve also never met a person who downgraded their car. For most people every successive car has to be bigger, faster and more expensive, so those numbers would go up.

Imagine what could be done with all that money. It’s enough on it’s own to pay for a R2 million house, and if someone invested that for the last 30 years of your working career, they’d end up with a R33 million rand investment account, in today’s money. They could be rich, but instead they’d rather have some new car smell.

Now I’m guessing you’re going to say that your expensive car doesn’t cost you nearly as much, and that you know much better than the AA on what it costs to make payments, run, service and insure, and that it’s nowhere near that amount even though it has twice as many cylinders and a much more prestigious badge on it’s rump. But what you’re forgetting is that you haven’t paid for your depreciation yet. At the moment it’s just an IOU. A heavy bulging anchor of an IOU that is dragged around and added to wherever you drive and will be collected on one day when you sell.

That’s the beauty of depreciation. Even though It’s not something you can see and feel or a service you actually get, it’s still there, an invisible force burning through money as if it was that last forgotten lamb chop on the braai. And we voluntarily do it all the time. Even worse, we do it using debt. We go to a bank and borrow money at stupid interest rates to buy something that doesn’t exist and keeps us poor.

That’s the beauty of depreciation. Even though It’s not something you can see and feel or a service you actually get, it’s still there, an invisible force burning through money as if it was that last forgotten lamb chop on the braai. And we voluntarily do it all the time. Even worse, we do it using debt. We go to a bank and borrow money at stupid interest rates to buy something that doesn’t exist and keeps us poor.

So what are we supposed to do? How can we avoid or at least minimise our costs of getting around?

Ideally, you can go car free and walk and bike everywhere. Even if it means spending more on rent or buying a more expensive house, you’re still likely to have change left over from the R20k you would be spending on your beemer.

You can also go car free for un-bikable trips by switching to an Uber. The total cost per km for most Uber trips is in the R8 to R10 per km range, so at an average or R9 a km the R20k you were spending on your own car will give you over 2200 Uber kilometers a month. That’s likely even further than you drive. If you only used Uber as much as the average the in the BMW example above, you’d still save over R5000 a month, and have time to get things done while you’re a passenger.

You can also consider a small motorbike or scooter. R20 000 buys you a decent small bike, and a scooter costs even less. And that’s it, you’ve capped your depreciation to under one months costs for your piece of Bavarian engineering. Plus you’re likely get back a large portion of the purchase price when you sell one day. While in use, they’ll take very little petrol, cost next to nothing to insure, save you a monstrous amount of time in traffic, and you can easily service them yourself.

There’s really very little downside, apart from death as my wife keeps telling me. I always reply that the reduction in traffic stress more than cancels out any accident risk factors through a reduced risk of a heart attack or stroke. Science backs me up with this too. Fortunately she seems okay with me riding my 85km/h electric bicycle!

But what if none of those options work for you, what if the only way you can survive and keep your job is to own a car. Is there some way to minimise the damage they inflict on our wealth?

Fortunately there is. The main culprits in the ludicrous costs are loan repayments and depreciation, both of which you have some control over.

The first issue is really easy to deal with. Buy a car cash. If you’re not buying your first car because there’s no way to get to your first job then you have no excuse. If you don’t have the money you can’t have that car. The end.

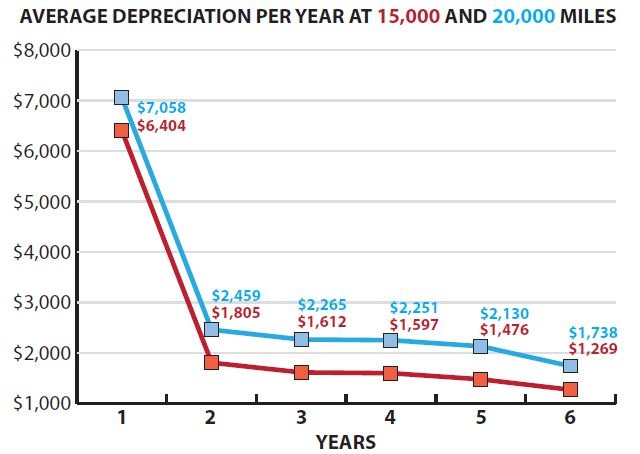

Then on to the depreciation problem. If you google, you’ll find loads of articles and charts showing pretty much the same thing. Cars lose the most value in their first year, the next most in their second and then a little more for all the rest of the years. Here’s one example of a chart like that from a website called businessfleet:

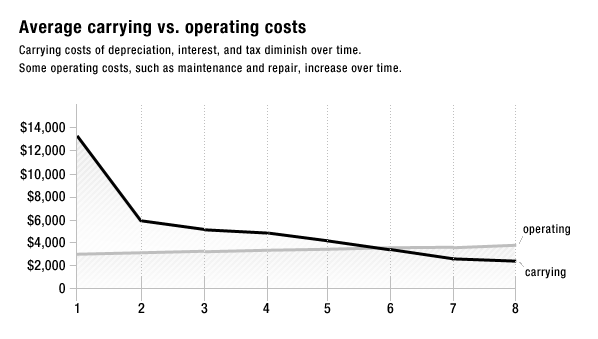

This graph from consumer reports shows pretty much the same thing, but they’ve also charted the maintenance costs on it:

This graph from consumer reports shows pretty much the same thing, but they’ve also charted the maintenance costs on it:

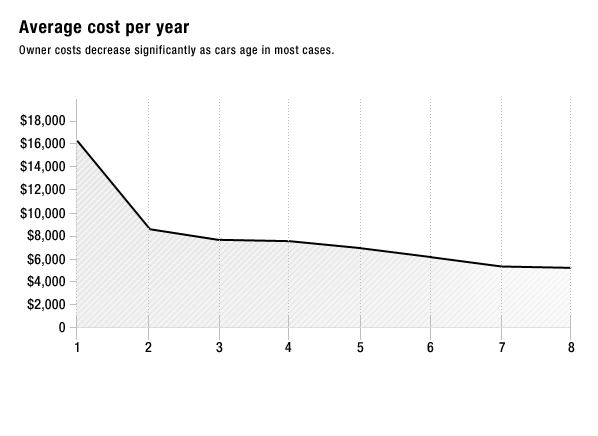

Yes as expected, maintenance costs do increase over time, but fortunately their increase is at a far slower rate than your car loses value from depreciation. If you add all of the costs together, as consumer reports did, you find the last chart containing the overall costs per year of owning a vehicle:

Yes as expected, maintenance costs do increase over time, but fortunately their increase is at a far slower rate than your car loses value from depreciation. If you add all of the costs together, as consumer reports did, you find the last chart containing the overall costs per year of owning a vehicle:

What this confirms for us is that consumer reports makes the most boring charts on the planet, but it also shows that the first two years of owning a car are the most expensive. After that the costs decrease every year, and would continue to do so over the life of the vehicle. In a modern car this is expected to be 15 years or 300 000 kilometers, whichever comes first. So this can give you a strategy for buying, as I’ll show you with the steps I used for the last car I bought.

What this confirms for us is that consumer reports makes the most boring charts on the planet, but it also shows that the first two years of owning a car are the most expensive. After that the costs decrease every year, and would continue to do so over the life of the vehicle. In a modern car this is expected to be 15 years or 300 000 kilometers, whichever comes first. So this can give you a strategy for buying, as I’ll show you with the steps I used for the last car I bought.

Step 1 Identify the car type you want

I wanted 5 seats, 4 doors and a separate boot. Of course, like most people should, I also wanted low fuel consumption, low running costs and the best reliability around. Out of that, I only considered a Toyota Corolla or a Nissan Almera. Yes I know they’re pretty boring Jap brands but I know their parts are cheaper. I eventually settled on the Almera mostly because my dad owned a Nissan dealership at the time so I thought I’d get a discount on parts and servicing. Of course he sold it a year after I bought the car, so it was regular dealerships for me.

Step 2 Predict how much driving you’ll be doing

Considering I don’t drive very much, maybe 12000km a year, getting a low mileage car wouldn’t be good value for money. If I bought a car with just 25000km on the clock, it would only have 180000km at 15 years old, well short of it’s 300 000km lifespan, so mileage wise it would be fresh, but it would be old in years.

That would mean I would be carrying extra driving inventory I couldn’t use. Because of that, I could buy a high mileage car. Mine had 67000km on the clock, which is very high for a 2 year old car, but after 12 years it’s now on 205000km. When it’s 15 years old it will be on about 240000km, so it will be closer to the right amount of use. I could have gone for an even higher mileage car.

Step 3 Shop

Because the car I chose had such high mileage for a 2 year old, it was much cheaper than the rest, and considering it had a full service history, and not even the slightest issue, I had a good feeling that it would be reliable. It has been, very reliable, I’d get in today and drive to Cape Town without a second thought.

Step 4 Maintain your car well and drive it for as long as possible

Another bonus of driving an older cheaper car is that you’re not too worried to take it to interesting places. In this case, the mountains of Lesotho.

I service my car as per the schedule. I also take it to the dealership, as they should know best how to handle it. There are many benefits to driving your car longer. As the value of your car drops, the insurance should drop too. My car costs me R260 a month to insure comprehensively. Depreciation also eventually levels out. My car has been valued in the low R40k region for the last few years, and seems to be staying there. And one final benefit to driving a cheap boring car… You know when people say someone is compensating for something with their fancy sports car? With my car they know I clearly don’t have that need!

So to summarise, and in order of importance:

1) Don’t drive, or drive far less

2) Buy a 2 year old car and drive it forever

3) Make sure what you buy is reliable and cheap to run

4) Invest any savings you have, not doing that would be idiotic

Now if you can’t figure out why you’re not getting ahead, you should probably go look in your garage.

*Just so I’m not accused of picking on BMW drivers, South Africa’s most popular car, which like the trump voting clowns in the USA is actually not a car but a bakkie, the Hilux specifically will cost you R9.11 a kilometer for the petrol double cab. That means all those drivers could be spending R23 500 a month on driving..