Updated September 2020 with a step 2c…

Updated again September 2021 with no need for step 2…

I want to live overseas at some point in my future, so I’m working my way towards earning a foreign passport. Now there are a number of ways to get those handy little visa exemption books. One way is to sell six of your kidneys and buy a mansion in Cyprus.

Fortunately I married a stunningly beautiful Portuguese woman, and as the Portuguese are extremely welcoming of foreigners, that means that all I have to do to get a great passport is to become fluent in Portuguese and get some documents from home affairs sorted out.

And that’s made me wish I had 7 kidneys, because I think trading 6 of them for a passport would be far less painful than what I’ve had to do. And I’m not talking about my attempts at studying Portuguese, because it’s rather easy adding a sshhh to the end of every second word, but let me tell you what isn’t easy…

Every Friday for thirteen months I would leave work at 1:30pm and head to one of the portals to hell home affairs offices near to my house. There I would stand in a very long queue before getting to the front to be told it was the wrong very long queue so I should go stand in another very long queue.

After eleventy four hours I’d eventually reach the front of the last very long queue where I’d have to write my complete family history all the way back to Adam and Eve into 2.5cm space on a tatty piece of toilet paper, empty my wallet onto the table and repeat everything I said in the last six appointments while I try and get something called an unabridged birth certificate for myself.

All this even though I already have my birth certificate at home, but apparently it’s too abridged, whatever that means. My guess is that an unabridged birth certificate must be printed on Unobtanium coated paper, and they’re waiting until they’ve collected enough Unobtanium from the moons of Pandora to fill up their printer.

You have no idea what hell it’s been, but luckily for you I was once a barman, so I know exactly how to explain it.

First head to a bar, Saxonwold shebeen or stop for a visit at Bathabile’s place. Then ask for a tot of Amarula and a tot of lime cordial in separate tot glasses. Take the Amarula, and swish it all around your mouth but don’t swallow it. Then take the lime cordial and do exactly the same thing.

Doesn’t it sound delightful? The creamy sweetness of the marula fruit with a sour hint of the lime.

Clearly you weren’t paying attention in biology class otherwise you’d know that lime causes the cream in the Amarula to curdle almost instantly and you end up chewing on what feels like an extra large sweaty gym sock. And it’s impossible to swallow it so now you’re choking. And then your body says no way and you start to gag, but because your mouth is full of sock the vomit comes out of your nose. It’s not a pretty site, but I think it might just give the faintest idea of what it’s like going to home affairs every week for thirteen months.

When I tell people what I’ve been voluntarily doing to get that passport they automatically assume two things. 1) I’m mad, and 2) that I’m doing it to run away from South Africa and it’s problems. I’m neither, we think. I merely want to explore parts of the world where I can walk around in the evening without getting killed twice every night.

They also keep telling me I’m making a huge mistake taking my money out of SA because after all the years the South African economy has been under-performing (no it’s gone backwards), it’ll do extra well in future to make up ground. Clearly they haven’t heard of Zimbabwe.

But don’t worry about that, because South Africa is nothing like Zimbabwe. South Africa is the richest country in Africa. It’s too big an economy to fail. The richest countries always do fine, like the USA in North America or like Germany in Europe.

We’re not like Zimbabwe at all, we’re a very stable democracy, the most developed economy on the continent, and we have loads of natural resources. We are in fact, a lot like Venezuela, from some time ago, when it was the richest country in South America, with the strongest democracy on the continent, and bucket loads of natural resources…

Well not quite. You see, in 1950 Venezuela was actually the 4th wealthiest country in the world according to GDP per capita. We’re not even the 4th wealthiest in Africa using that measure, we’re 7th! Our only differentiator from Venezuela at the moment is that we have a very skilled and level headed president, if he’s actually in power. Even so, I’m not sure that can save the economy, though it should slow the demise. And if he goes we might as well wave a white flag and wait for the IMF.

We might get lucky though. There is of course that giant oil discovery that was made just offshore last year, and that could bring in brazillions of dollars if it’s done right. By done right I mean done by someone who actually knows what they’re doing, which of course means an instant disqualification from the interview panel if our state enterprises are anything to go by. At the moment I don’t think I’d put anyone from government in charge of my son’s school tuck shop otherwise I’d have to have him vaccinated against killer polony and double Ebola.

I actually couldn’t give a damn about any of the usual South African horror news stories. None of it matters to me in the slightest, because I sleep extremely well every night knowing that pretty much all my assets are already offshore, living peacefully all around the world.

I never actually did that because South Africa was sliding downhill. It’s just that I think that if you only invest in one country you’re a complete idiot. Even if that country is the USA or South Korea or Lichtenstein. The fact remains, that it’s impossible to predict the future and therefore impossible to pick the economy that will be the most successful in the next few years. All those who say they’re staying invested for when the South African economy picks up again are actually saying that South Africa will be the single best performing economy in the whole wide world in future.

And can anyone really say that?

No, the fact is that we don’t know if South Africa will be top of the pile, in the middle of the pile or a great big steaming pile of horse… And that’s exactly as much as we know about all the other countries.

That’s why as I’ve said three times before this (1, 2, 3), you should invest in as much of the world as possible at the lowest cost possible. The end. And that’s not advice as I’m not licensed to give it, it’s just what all the research tells us. Doing anything else would be totally bonkers.

And that finally brings us to the meat of the article. What’s the best way to invest offshore?

Once upon a time investing offshore was something only the very rich could do. It definitely helps being very rich, but nowadays we have a number of different options depending on how much you can save each month, and how much you already have built up.

So let’s begin

Step 1) Investing R33 000 a year or less offshore

If you’re on this level going offshore is really simple. You open a tax free savings account with Easy Equities and you buy an offshore ETF like I showed you in my newbies guide to investing a couple of years ago. Anyone who’s done any decent research does exactly this. For a brief moment I thought ABSA stockbrokers was actually a cheaper provider, but they raised their fees so often they’re no longer the cheapest, and besides that, I don’t trust them.

So what should I buy in my TFSA to get my money offshore?

Well Kristia and Simon buy the Ashburton 1200 ETF (ASHGEQ) so they’re invested in 1200 companies in the developed and developing world. Stealthy and myself buy the Satrix MSCI World ETF (STXWDM), so we’re invested in the biggest 3000 companies, but just in the developed world. We both think the lower cost of this ETF outweighs the missing emerging markets. Either of those are more than good enough to get your money properly offshore.

If you wanted to get really good coverage you could buy 90% of the developed world (STXWDM) and 10% of the developing world (STXEMG) and then own the whole damn planet, but you’ll pay more fees for the developing side, and it would mean more work keeping the ratio right. I can’t do that, because I’m allergic to extra effort, and besides in the next section we get that ratio perfect automatically with none of the work.

But all of those are listed in Rand on the JSE, what if the Rand totally collapses?

That’s the beauty of being offshore. If the Rand collapses your share price will climb by exactly the same amount. So if you had R150 000 in your TFSA in STXWDM and the next day the rand went from R15/$ to R30/$ your R150 000 in the TFSA would jump to R300 000, cancelling out the drop in the Rand. Normally this would be a big issue because you’d have to pay capital gains tax on a rand gain that isn’t actually a gain, but happily in the TFSAs you don’t pay capital gains tax.

Step 2a) I have more than R33 000 a year, but my net worth isn’t yet $100 000, how do I invest the rest offshore?

Edit in September 2021:

In 2021 Interactive Brokers dropped their inactivity fee. This means that now instead of them charging $10 a month until you hit $100 000 in investments, now nobody has to pay that. In my opinion that makes them the best offshore broker available to South Africans.

If I was starting my investment journey today I would first top up my TFSA as above, and then I would jump all the way to step 3, skipping step 2 entirely! I’ll leave the old step 2 below in case anyone is interested in it.

Do you have a Euro based bank account? If you do, go to 2b) otherwise carry on reading… Edit in September 2020 actually now if you have no European bank account you can also go to 2c)

Remember that Easy Equities account you opened in step 1? Well it’s going to come in handy here too. Of course you still need to stick that R33 000 into the tax free part of your Easy Equities account. The tax man has been screwing us over completely for over 10 years now, so you should really enjoy the fact that this account is one they can’t ever steal from.

For the rest you need to put your money into the Easy Equities USD account and then inside of that you can buy Amazon, Tesla, Google or a whole bunch of other US based shares if you have a foolproof crystal ball, or you can be smart and realise you’re actually not smart enough to pick shares in real life (nobody is) and instead do that in the US version of the investor challenge game while in real life buy the Vanguard Total World Stock Market (VT) like I do.

How do I get my money into the Easy Equities USD account?

There are a bunch of different ways with different costs, so for now I’ll assume you want to move R17 000 or less into dollars, in which case the cheapest way is also the easiest way, with Easy Equities own Easy USD feature.

Now I could go and do long a write-up on how to use Easy USD guide, but Easy Equities has already done that, so go over here and give it a read or watch their video of it in action.

Step 2b) I have more than R33 000 a year, but my net worth isn’t yet $100 000. I have an EU bank account though, so how do I invest the rest offshore?

Once upon a time I was “residing” in Italy and therefore was able to open a bank account with N26. They delivered my card to my Italian address and sent me all my bank details in an email.

That meant I could also open an account with Degiro.ie as they’re happy to work with South Africans, as long as they have a European bank account. Next time you head to Europe do a little research to see if you can open a bank account while you’re there. It can save you 100% on your brokerage fees.

A 100% savings, how’s that even possible?

Degiro is a discount brokerage. A discount brokerage on steroids. They are quite literally the cheapest international broker I’ve ever found. How cheap are they? How about no monthly fees, and no transaction fees cheap? The only way to get cheaper would be for someone to pay you to transact on their platform, and I don’t see that happening ever.

They actually offer two accounts, the one is called a custody account, and the other a basic account. Both have no monthly fees, and both have a range of ETFs that they charge absolutely no transaction fees for. My favourite Irish ETF the Vanguard FTSE all world index (VWRD, well actually VWRL this time, hosted on the Euronext Amsterdam exchange) is one of those. Yippee!

So back to the two accounts they offer, what is the difference? Well with the custody account they take 3% of your dividends forever, and with the basic account they take nothing.

So why do they offer the choice?

Well with the basic account they loan your shares out to people who sell them, and then have to give them back eventually (this is called shorting a share and it means… Actually I couldn’t be bothered it’s far too boring a topic). In doing so, they get some rent from your shares which they keep instead of the 3% dividend fee.

Now the write-up in the T’s & C’s basically says that the only way you could lose money through this is if the person loaning the share and Degiro themselves both went bankrupt, so the risk may be very low, but it still does exist. It’s up to you to decide if having a completely free account along with transaction fee free purchases is worth the risk to you.

Until you reach $100 000 of course, because then you have an even better solution.

Step 2c) I have more than R33 000 a year, and no offshore account, is there any free option for me?

Edit in September 2021

As fate would have it, TD Ameritrade decided to no longer offer accounts to South Africans. Hopefully this doesn’t become a pattern… No need to worry though, because Interactive Brokers dropped their inactivity fee, so we still have a very low cost option available to South Africans of any wealth level! I’ll leave the step below just for interest sake, but feel free to ignore it.

Funny you should be mentioning that, one of my smart readers Joseph sent me a mail a short while ago to let me know that TD Ameritrade no longer has monthly fees, and they also have no fees on a whole bunch of ETFs.

That means you get the same 100% savings that you do with Degiro, but there’s no need to get yourself a European bank account, as they’re more than happy to work with South Africans!

So what’s the catch?

Well just like the Easy Equities USD account in step 2a) you can also only invest in the US stock market. That means you can’t buy Irish based funds, but just American. If you’re like me and plan on dying very very rich one day this isn’t the best option of course.

Fortunately as with step 2b) that only becomes an issue around $200 000 invested, and if you read this post in it’s entirety you’ll know that isn’t an issue at all as we’ll be fixing that in step 3).

So to put my cards on the table. If it was me just starting out again, what I would do now is follow step 1, then step 2c) 3), open an account with TD Ameritrade and buy VT Interactive Brokers and buy either VT or VWRD. Then when I got to $100 000 I would follow step 3).

Step 3) I now have more than R36000 a year to invest, what should I do next?

Regardless of how you got to the $100 000, either with Easy Equities USD or with Degiro (edit September 2020 or TD Ameritrade), you’re now in the big leagues, and that means you are entitled to open an account with Interactive Brokers that has no monthly fees and no fees on dividends.

You could have actually opened this account right from the beginning, but until you reach $100 000 Interactive Brokers charges a minimum fee of $10 a month, so it’s not really worthwhile.

Happily Interactive Brokers has no strange bank account requirements for opening an account, It’s available to all South Africans. If you have $100k ready to invest, I really think this is the best way to do it.

Now at the moment your investments will be with Easy Equities USD or Degiro, but once your account is open with Interactive, you can simply transfer your $100 000 worth of shares from either Easy Equities USD or Degiro into your Interactive brokers account directly (no selling and rebuying). This is known as a position transfer, and it won’t trigger any taxes from SARS. There is a small fee for this, probably around two or three hundred Rand.

Now Interactive Brokers does have transaction fees, but they’re tiny, just 0.08% (less than a quarter of what easy equities charges) with a $1.70 minimum. It’s far lower than any other brokerage apart from Degiro, but in this case nobody is loaning your shares out, which I think makes up for the tiny fees.

If you compare it to the Degiro custody account, the dividends of 2% on VWRL would mean you’d be paying about $60 a year, or $5 a month in fees if you had $100 000 invested there. And one day you’ll hopefully have $1 000 000, in which case using a custody account with Degiro would cost you $50 a month, but you’ll still pay nothing with Interactive Brokers unless you transact that month.

If you’re able to reach this point you’re going to be rich. You’re in the realm of building wealth on auto-pilot now. Well done! Just FYI a few people have asked if I wanted Tiered or Fixed pricing. In almost all cases Tiered is much cheaper. If you trade millions of dollars at a time fixed may be but for me everyone who isn’t a Musk or Zuckerberg go for Tiered.

Edit on 2021/06/09: Use a referral account! My wife opened her account using my referral code and funded it with $100k and got an extra $1000 from Interactive Brokers!!! If you want to you can use my code and I’ll get $200 too, but feel free to use a friend, spouse or family member too. My code is https://ibkr.com/referral/patrick616

Then all you need to do now is transfer any more savings you have directly into their bank account.

And how do you do that:

Annex A)

There are a number of different ways of moving money offshore, of which the banks are typically the worst. Well okay maybe that’s going a little too far. The worst would be to stick money into an envelope marked cash and dropping it off at the post office, but a very close second would be asking your bank to assist.

Now you’re probably thinking that you’ve spoken to your bank or read an article like this one and that since your bank only charges R151 to make an overseas transfer that it’s going to be much cheaper than any of the options I’ve suggested.

So why shouldn’t you use them?

Because they’re lying to you. What that article and your bank conveniently forgets to mention is the spread. The spread is the difference between the real rate and the rate they offer clients. As Maya on Money showed a while back, with the banks the absolute lowest spread is 2.15% for Standard Bank, with Nedbank at 2.37%, ABSA at 2.57% and FNB at 3.22%.

Now I’ve used a bunch of different providers to move money offshore, always changing whenever I find a cheaper option, so I’ve put together a calculator to work out which option to use depending on how much you’re transferring offshore. Now be advised that it’s hard to get exact figures on the spread as well as all the fees, so while I believe that these rates are accurate according to what I’ve been told by all the providers, it’s worth confirming yourself before you do anything.

Here’s the link to the calculator, as always I’ve tried to make it idiot proof, so it’s super simple to use, just change the yellow field and check which amount is highlighted in green. Below I’ll show you a few examples of how it works:

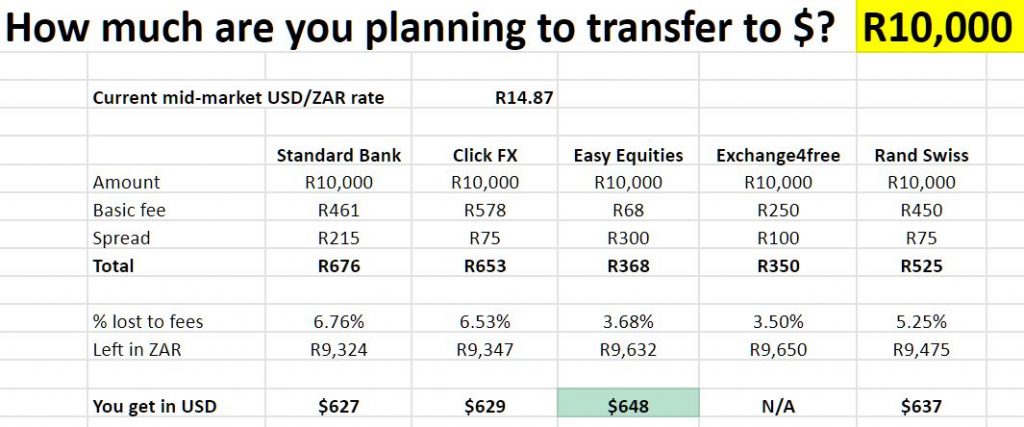

What’s the cheapest way of transferring R10 000 into dollars?

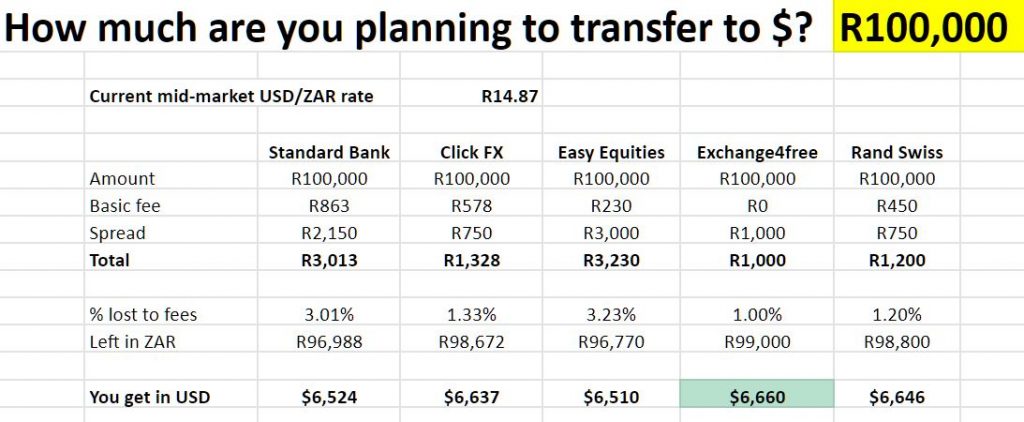

What’s the cheapest way of transferring R100 000 into dollars?

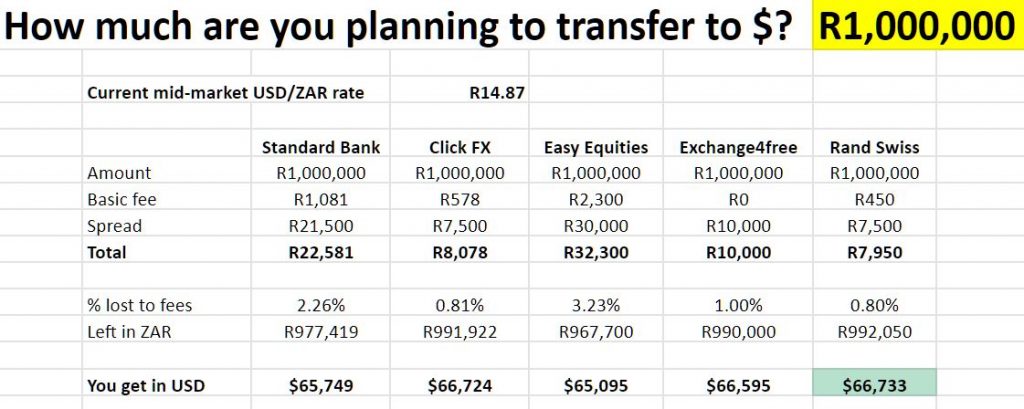

What’s the cheapest way of transferring R1 000 000 into dollars?

All of the providers listed above I’ve used personally, so I trust them. And the reason I only listed Standard Bank is because they’re the cheapest SA Bank when it comes to forex transfers.

None of the providers have ever given me any money, so there’s no bias. I’ll also be sharing this spreadsheet with all of them so they can double check my calculations, and I’ll update it if there’s mistake.

Feel free to follow me on twitter: @TravelBugBitten

*Edit: Actually Exchange4free seems to have an affiliate program. No idea what it pays, but if someone feels like putting investorchallenge.co.za as the affiliate code I’ll find out.

Interactive Brokers also has a similar scheme, so if you use this link I’ll get some money from them too.