Well not exactly you of course, you’ll be dead. And not in terms of funeral costs, church costs, hall hire, catering, burial site, flowers, tombstones, etc, you already know about those. These are different. Do you remember the time SARS said they were raising taxes, and you replied “Over my dead body”. Well yeah, they were listening, and now have plans to take massive amounts of money away from your kids one day.

Continue readingA short history of investing really badly

I invested really REALLY badly over most of my life.

For 5 years I was in cash. And not good cash that earns more interest than inflation, I used the worst kind of cash. Money in my bank account earning literally nothing. After I account for banking fees with my then stupid choice in bank I not only lost to inflation, but I actually paid money so that I could lose to inflation. Looking back now I can see that something was very wrong with me. Medically speaking I may have been mad.

Continue readingThe 20 year plan

Dear Investor Challenge,

I’m 22 and I just started adulting, doing a 9 to 5 as a PR specialist. I guess nowadays that means I know how to use Facebook and Twitter to create fake news so my clients look innocent while they loot and plunder. Now I’m a millennial and that means I live entirely on Chai soy lattes and avocado toast. It also means that I want to have a proper work-life balance, which is why I was so thrilled to read your last blog post.

Really, that stuff was lit, I can’t believe it didn’t break the internet, you’re so woke! I’d love to work only half the time so I can finally have time to take care of all the stuff that gives me FOMO, and sharing jobs is just as brilliant. The world would be a better place if the people who wanted to work could. I’m more than happy to share mine with someone else, more time for me to bounce for some #VanLife with my bae and my Labradoodle Frodo, and a salary for some other he or she so they can buy a van too, win-win!

The problem is my boss is such a boomer. When I told her she was all sus and said I’d never get anywhere in life if I thought like that. She even said I’d never be able to afford a house or send my kids to private school. I think she’s just jealous because she’s under a truckload of debt just to afford her boring McMansion and an expensive horse habit. I can’t even.

Now since I quite like getting paid to troll people on Twitter, is there anyway I could still make this 50% working time thing work for me?

Jed Dye

Continue reading

Fixing unemployment and everything else

I have a feeling this post is going to be one of the crazier ideas I’m putting forward. I’ve actually had it in draft for a couple of years now, but I think the time is right to post it. At the end of this you’ll either think I’m a genius, or a raving lunatic.

It’s been 6 weeks now that my wife has had no clients walking into the salon to get a haircut. 6 weeks with no income. 6 long weeks. You might be lucky and still have some or all of your salary, but plenty of people don’t. I’m sure a lot of you either have the same problem, or know people who do.

Now she’s a very smart lady (exhibit A, she married me), so she quickly came up with new ideas on selling pre-mixed hair colour solutions to her existing clients and selling mothers day packs to be delivered, but the money from this will go into the salon account, so she can pay her staff for as long as possible.

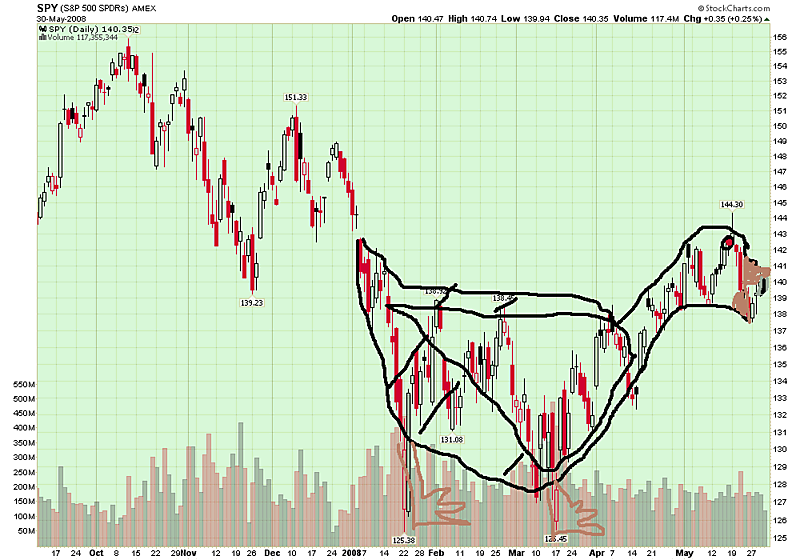

Continue readingOh no, not the black swan pattern!

The western world once thought that all swans were white, because up to that point they’d only ever seen white swans. Then a Dutchman called Willem de Vlamingh took a boat to Australia and while trying unsuccessfully to catch an Aussie, discovered a black swan instead, and changed zoology profoundly forever.

Continue readingJust in case you’re wondering…

I’m fine, just rather busy at the moment. The week before last I was in Mozambique looking at the situation 1 year since Cyclone Idai, and since then I’ve been hugely snowed under in activities and preparations related to COVID-19.

I do have a blog on how I’m dealing with the markets at the moment, but the short version is, I’m not concerned and doing what I’ve always been doing. Hopefully the longer version will come out soon.

Until then, wash your hands often, try not to touch your face, and enjoy some time at home 🙂

My 2019 spending, AKA how to blow a budget

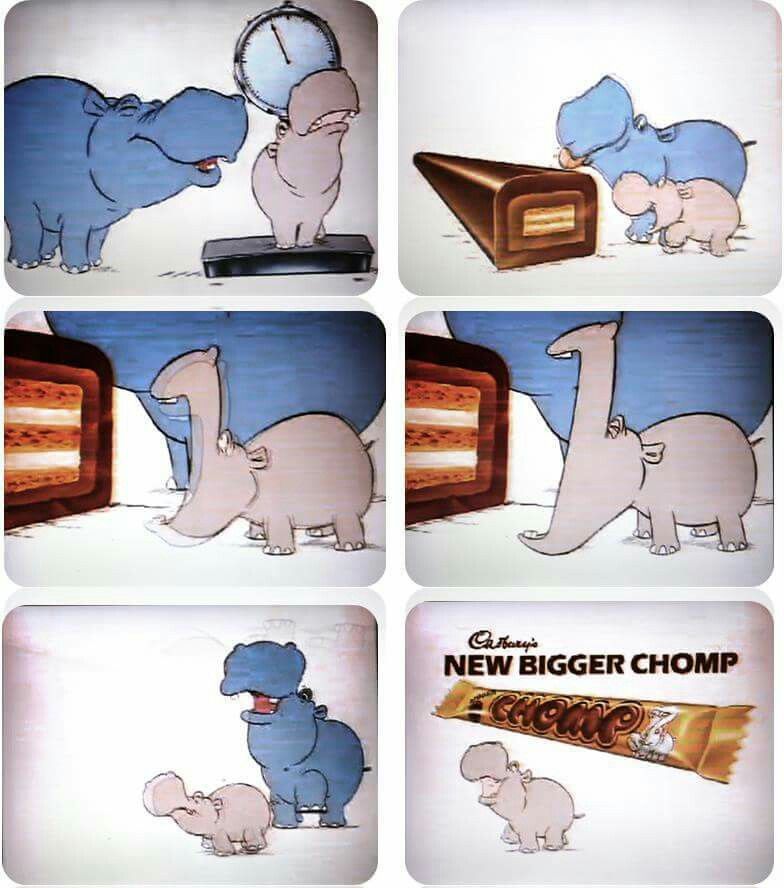

When I was a young kid, my mom used to buy my brother and I those big party-sized bags of Chomps, obviously trying to turn us into big strong hippos as the advertising suggested. There was an unspoken agreement that we had to share equally, and usually when my brother went to get one, he’d ask me if I wanted one.

After a while, I got an idea. If I skipped a turn, the next time my brother went to get one, I could have two and feel really indulgent. After a while I’d skip two turns, then three so I could stuff my face with 4 chomps the next time my brother only got one.

Continue readingThe top 9 things I learnt in 2019

Welcome to the 20s. If the last 20s were anything to go by we’ll be in for massive market gains followed by the biggest crash in history! Well either that or we’ll all start listening to Jazz and buying alcohol from the mafia. Anyway, let’s get straight into the top 9 things I learnt about money last year.

5 numbers you should be tracking to achieve financial independence

Not everyone wants to be able to resign from their jobs. Some love working, while others don’t. But being financially independent isn’t necessarily about being able to tell your boss what they can put their TPS reports, it’s about being able to weather a financial storm.

For that, at the very least you need a rainy day fund for emergencies. But you might find that once you’ve been able to build a decent rainy day fund, that you’re even more motivated to save and invest more, and then one day you’ll have an investment account so big you’ve got to check it for swimming cartoon ducks. If you’d like that to be you one day then these should be the numbers you focus on:

Continue readingHow to retire WELL as a couple on just R20 000 a month

R20 000 a month. That’s real money, double what we gave ourselves when we first started this fantasy game. And for the first time it’s actually enough to live in major South African cities. Using the calculations I run for these searches, both Durban and Port Elizabeth make the cut. So does Lagos in Nigeria, oh dear.

Continue reading