Like many people nearing the end of their working career, Andre and Lisa can’t wait to travel the world when they retire next year. Unlike most though, they won’t be enjoying any pensioner discounts along the way. That’s because Andre will be just 46 years old, and Lisa practically a teenager at 36!

When most people hear this they generally assume that the couple have either inherited money, got a BEE deal, or lived a totally dull life and never left the house so they wouldn’t spend any money. But this couple have had none of that luck, and as you’ll see a little further on and in the slideshow at the bottom of this post, they most definitely haven’t spent their time sitting at home eating beans and rice by candlelight.

Of course I had plenty of questions for them, and thankfully Andre was kind enough to answer, and boy did he answer well.

You’ll want to read this interview!

Let’s start with your story, tell us a little about yourself?

I suspect most people will find the backstory rather boring as we’re all aware (if we’re honest with ourselves) that there’s no magic formula for wealth creation. It comes down to making the right choices when it matters and be disciplined enough to stick to your plan throughout.

Nevertheless, here goes. I’m a pretty average example of a pretty average guy born in 1972 in the Pretoria area to pretty average middle class parents who separated when I was around 10 years old. As a kid I delivered newspapers, grew and sold vegetables and generally hustled or made deals wherever I saw an opportunity. We moved around the country quite a bit and I attended a number of different schools before matriculating in a small rural town in the Cape Province. From there I shipped off straight away for a year of national service and after conscription I applied at university to do a BSc Computer Science. I was fortunate that my parents could help with some course fees but I had to supplement it with a student loan and worked part time over weekends and holidays. Back then computer studies was much more a theoretical science and career options were mostly development related which did not appeal to me much. At the time I was more interested in networks and systems which was an exciting new field and after varsity I started working as a computer technician in Cape Town while completing specialty courses part-time (Microsoft MCSE, etc). Throughout the mid-90’s I stayed with the same company and we branched out into providing IT solutions and networking services to small / medium sized businesses. It’s an environment with high stress and low margins so early 2000’s I took a post at a university managing IT for one of the faculties – where I am to this day! Around 2004 I met my wife while she was still studying and we’ve been married for 10 years now!

If you don’t mind sharing, what’s your current net worth?

Our net worth is currently knocking on R13 million. This includes property, retirement savings, investments, cash, vehicles and personal items. The property portion accounts for around 65% of the total right now but we plan to reduce that closer to 40-45% over the next year. Retirement savings (RA’s, pension fund and TFSA’s) make up around 15% and equity should be around 35% after we have adjusted the property portion. The remainder is made up of cash, vehicles, personal belongings and some odds like gold and a tiny bit of crypto – just in case 😉

That’s a truly enormous pile of dough, how did you get there, ie. what’s the history of the stash?

Slowly but surely. 🙂 I always knew that saving and smart lifestyle choices would make a difference to the net result but what I came to understand very early on was that you need money to make money and the only way for salary earners to get ahead is to find a way to gear what you have without incurring too big a risk. For me this was in the form of buy to let property – I purchased my first flat as soon as I could scrape together a deposit and along the way kept my cost of living as low as possible. It’s entirely feasible that investing in the stock market at that stage would have been more lucrative over the same term but the tangibility of property as well as the goal orientated strategy of getting rid of debt (in the form of home loans) matched my style of saving and investing. We’ve had no ‘lucky breaks’ or ‘windfalls’ and our wealth was generated primarily due to diligence and meticulous planning. Fact based analysis and scenario based forecasting are processes that require a thorough understanding of a number of influencing factors and it’s critical to base decision-making by being realistic and honest. Time is your friend when it comes to investing and as long as you remain disciplined and stick to your plan, you will reap the rewards.

Did you make any major money mistakes?

I guess ‘major’ is a relative term and hindsight is always perfect. During the late 90’s my first foray into buying shares was a disaster as I got swept up in chasing the next DiData and pretty much lost it all on red – which put me off the market completely. I also managed to mistime the pre-2008 housing bubble – pouring most of my funds into a building project in 2003 and selling it just too early to fully take advantage of the massive growth during that period. In the same vein I purchased an apartment during 2008 right at the peak of the bubble which has not seen any real growth in the following 8 years! But generally speaking if the groundwork is solid the risks are contained and I’ve never regretted an investment decision – I’ve rather regretted many a lost opportunity.

You’ve achieved what most people only dream of, where did your financial skills come from?

Although I did not agree with all of it, in 1997 I found Robert Kiyosaki ‘s Rich Dad Poor Dad a real inspiration – at least to understand the importance of financial literacy, building wealth through investing in assets and working towards financial independence. The idea of not being a slave to money but rather let your money work for you sounds clichéd but most people tend to get caught up in the system of spending and instant gratification rather than honestly assessing their financial state and determining an achievable goal for themselves. Making poor choices is the biggest stumbling block. Having to have worked as a kid also taught me important lessons in discipline and the value of ones earnings.

What are your current plans for your post working life?

We’re still aiming to work for the next year and depending on projects we’ll start wrapping things up towards the end of 2018. Our short-term plan is getting rid of all personal possessions down to what fits in a smallish backpack – obviously apart from our investment properties. Our strategy is not to be based anywhere specific for any length of time and we’re open to taking things as they come. We’ll probably head back East for a while as we’re well used to travelling for extended periods with very little in terms of luggage. If or when the wanderlust runs out, or we need a break, we might stick around an interesting spot for a couple of months to recharge the batteries and/or curb the spending. The long term plan is to keep travelling indefinitely.

We’re still aiming to work for the next year and depending on projects we’ll start wrapping things up towards the end of 2018. Our short-term plan is getting rid of all personal possessions down to what fits in a smallish backpack – obviously apart from our investment properties. Our strategy is not to be based anywhere specific for any length of time and we’re open to taking things as they come. We’ll probably head back East for a while as we’re well used to travelling for extended periods with very little in terms of luggage. If or when the wanderlust runs out, or we need a break, we might stick around an interesting spot for a couple of months to recharge the batteries and/or curb the spending. The long term plan is to keep travelling indefinitely.

Have you travelled before? Any favourite places?

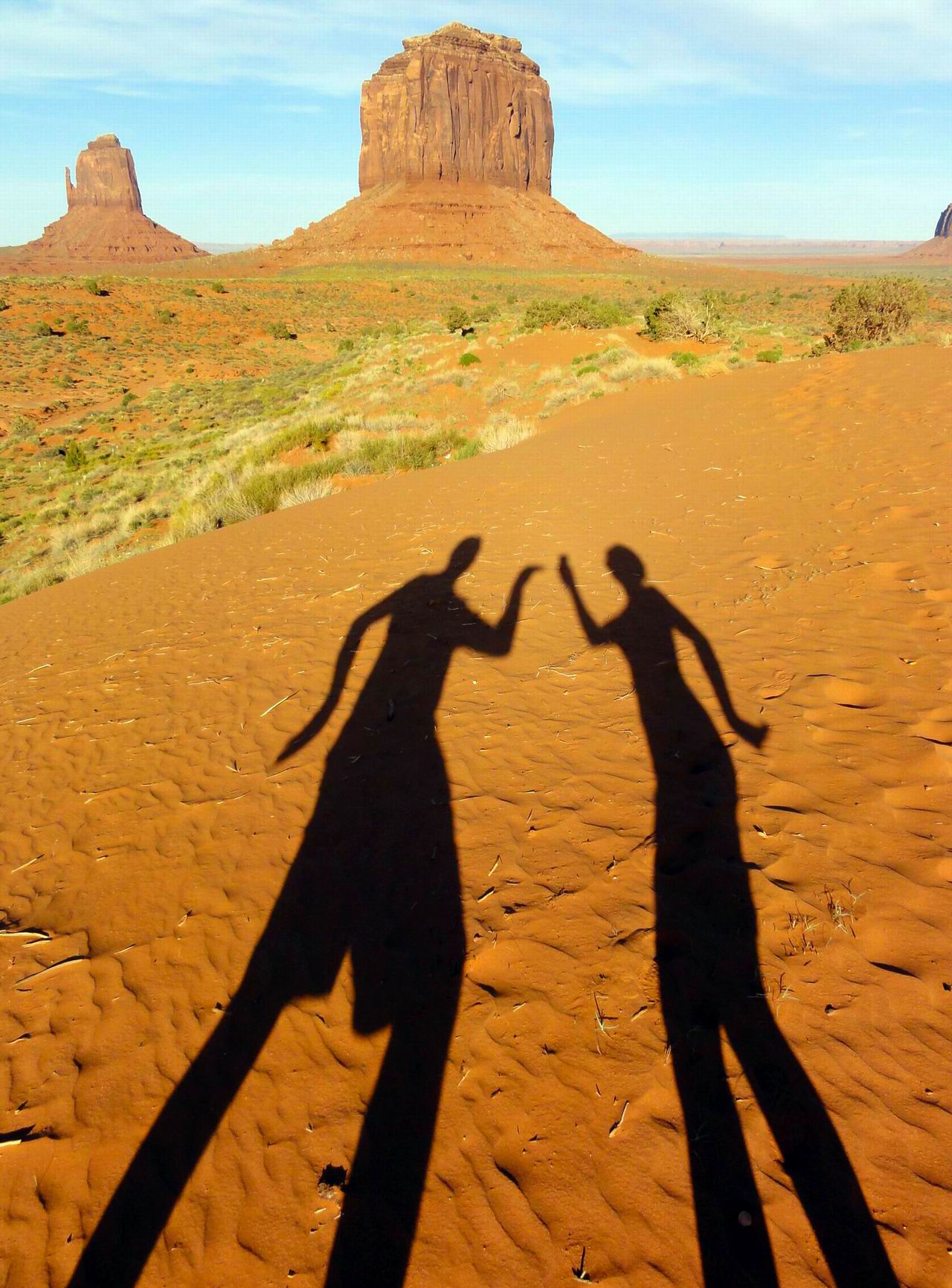

We’ve had some memorable trips for sure! We obviously both love to travel and the independent, off the beaten track type of holiday fits us best. Usually we piece together as much time off-work as possible to maximize our trips and over the last 10 years have tried to travel at least 3-4 weeks per year. We have not been anywhere near everywhere and usually travel very slow for a more relaxed experience. Especially South East Asia is an extremely attractive destination not only for its affordability but also for its diversity. It’s hard to single out favourite destinations but some trips that stand out include riding a motorbike from Ho Chi Min City to Hanoi, island hopping from Thailand to Singapore, hunting volcanoes in Java and road-tripping the USA. We’ve learned many a lesson over the years from our travels and travelling is an enriching, humbling, life-changing experience. Although full-time travel can at times be hard work, the draw of the unknown, the excitement of new places, cultures, friendships and food can be irresistible once you open yourself up to the opportunity of learning and experiencing.

Where did the idea come from to retire early?

We always wanted to travel but it took a while to wrap our heads around the idea that early retirement was the real key to reach that next stage of our lives. It’s somewhat of a mind-shift to understand that we do not HAVE to follow societal norms and as unnerving as it may be to go against the grain, one has to believe in yourself and your goals. Initially we planned to just take a travel break of a couple of years then get back to work. We also thought about spending a year or so working in other countries as a way of experiencing a different part of the world but eventually we saw the bigger picture and we realised that retirement and full time travel can be achievable.

Were both of you on board from the start or did one of you need convincing?

I always joke and say my wife is just a prettier, smarter version of me and that’s why I love her. Jokes aside, I guarantee you that financial independence is a much more achievable reality if you don’t go at it alone. Not only for the real-world financial benefits (such as lower overall cost of living and shared tax burden) but also for the mere fact that if you share in a financial goal and have the same attitude about money and spending you will have a much better chance of success. Pooling all available resources to maximise spending efficiency and, ultimately, growth potential is something often missed by most households. There is no room for “my money” and “your money” in this game. I have no doubt whatsoever that we have managed to achieve what we have in such a relatively short period only as a result of being in absolute agreement and mutual support on all financial decisions. Looking beyond finance the greatest test of any relationship is to travel together; which we have done through the best and worst. The take-away is that opposites do NOT attract and the small things DO matter.

How did you know when you had enough money to be able to leave working life?

We always knew that we did not want to follow the accepted ‘normal lifestyle’, so we worked as hard as we could, spent as little as possible and saved up as much as we could. One major influencing factor was our decision not to have children, as children (or any dependent really) not only complicates the question of “when is enough enough?” but also inevitably affects your overall cost of living. But when IS enough, enough? Initially we were aiming for a date, more so than for a specific amount, not so much planning early retirement but taking an extended travel break. Somehow these two factors managed to converge along a workable timeline. Could we possibly put our faith in the system to provide us with an income just based on our savings? The 4% rule provides for a good starting point here. There will always be a factor of uncertainty regardless of how well you are prepared. But be prepared regardless I would suggest.

We always knew that we did not want to follow the accepted ‘normal lifestyle’, so we worked as hard as we could, spent as little as possible and saved up as much as we could. One major influencing factor was our decision not to have children, as children (or any dependent really) not only complicates the question of “when is enough enough?” but also inevitably affects your overall cost of living. But when IS enough, enough? Initially we were aiming for a date, more so than for a specific amount, not so much planning early retirement but taking an extended travel break. Somehow these two factors managed to converge along a workable timeline. Could we possibly put our faith in the system to provide us with an income just based on our savings? The 4% rule provides for a good starting point here. There will always be a factor of uncertainty regardless of how well you are prepared. But be prepared regardless I would suggest.

What percentage of your income were you saving every month?

Perhaps one should rather ask “how little should I spend on stuff I don’t need ”than “how much can I save”. As our investments have predominantly been in buy-to-let property we tended to park all available funds in home loans to maximise savings in interest. If you plot a line to show the percentage of income saved against your goal it almost exponentially curves upwards as you get closer towards the goal. You end up having more and more available to save as your liabilities decrease. This goes hand in hand with limiting your living expenses but for us, realising savings upwards of 50% of income was achievable. My wife started working for herself as an independent consultant around 3 years ago and by keeping costs low (home office, no staff) this has given our income a substantial boost at a time when it mattered most.

Do you keep a budget or just try keep costs low?

You cannot know where you are going if you do not know where you are. For me this is even more important than just simply keeping a budget. I’ve been meticulously recording all expenses and earnings for over 20 years in my favourite program – Quicken Home. Every banking account, asset and liability I’ve made use of is reflected in a single system of reporting. At the press of button I can tell exactly how much we have spent on pretty much anything over a 20 year period and the exact state of our current finances. Some people (most actually!) might see this as complete over the top obsessive compulsive behaviour but I can guarantee you that having the real picture of your financial status brutally laid out in front of you has major benefits. There’s nowhere to hide from your bad choices and you have to be completely honest about your finances. Nowadays there are many tools available to make this process a lot easier than it was 20 years ago and in my view this is the single most important step people can take to financial freedom. Note that I’m not using the term “financial independence” here – rather, “financial freedom” as is being secure in the knowledge that you are in control of your situation no matter what it is. Knowledge truly is power when it comes to personal finance.

Where did you put it?

Savings predominantly went into buy-to-let property with some contributions to more traditional retirement tools such as RA’s and pension funds. Once we made the decision that we would stop working we had to change our approach as the goal would be to reduce monthly expenditure by that point. For buy-to-let property to really make sense you have to gear your own contributions otherwise the internal rate of return starts dropping and your tax liability increases once you settle outstanding debt. But the goal was to first be debt free and then decide as to the best course for providing passive income. After we settled the last outstanding debt on property we started investments in ETF’s and is currently on a drive to move discretionary funds offshore for direct investment. This should over time give us a slight hedge against inflation and should also contribute to some tax savings due to the way foreign DWT is treated by SARS.

Are you planning on changing anything about your investments going forward?

Our properties are all in fairly sought after areas and should keep up with inflation. The rental is a nice constant but far from the best income generator once you cannot gear the funding. When you own property outright your internal rate of return drops and unless you have a very good ratio of rental income to capital you’re really just adding risk (in the way of maintenance and tenants) to a fairly middle of the road yield. Even though we’ve seen good growth on our properties (mainly due to location) it still barely keeps up with inflation (on average 6.20% p.a.) and the real inflation beating return should be from rental income in addition. This is a complicated sum as you have to base the rental income after expenses over the unrealised gains of the property – which I calculate as around 3.5% p.a. inflation adjusted on our higher value properties. (This is not the same as the rental yield ratio which is used as a way of determining the profitability of a buy to let property). The rental yield ratio is generally poor on higher value properties in sought after areas mostly due to the purchase cost of property spiralling away from rental market affordability. In an ironic twist our ‘loser’ apartment purchased in 2008 now yields almost double in rental return (based on the unrealised gains) than the more expensive properties. Sadly it’s offset by very low capital growth but it does show that there is still value in buy-to-let properties in certain sectors of the market. Just pay close attention to the rental yield ratio from day one. Another issue is that CGT doesn’t care much for inflation so you could actually be even worse off over time. More importantly for us as potential perpetual nomads is that the capital remains locked up in property which will be a complete loss when we’re de ad so one should structure assets to eventually deplete. Keep in mind that we do not have any dependents and there’s no sense not to draw down on assets over time.

ad so one should structure assets to eventually deplete. Keep in mind that we do not have any dependents and there’s no sense not to draw down on assets over time.

Over the next 12 months, while we both still earn an income, I plan to keep moving our available discretionary funds to Europe and invest directly into cost-effective ETF’s. We’ll sell our primary residence and do the same with the proceeds. According to my calcs our offshore portfolio (which should then be 30-35% of total portfolio) invested in a low-cost product with a predicted growth of 10% p.a., 2% dividend yield, 7% inflation, 5% fiscal drag and a 7% annual increase in drawings will deplete the holdings in 50 years, while allowing for a draw of R240k p.a. from year one (after tax). Dividend Withholdings Tax is calculated at 20% but in theory, we should be able to pay less if our tax residency remains in SA. This income in addition to our remaining rental income will provide for more than what we need while travelling full time. We will probably over time keep shedding property and move more into equity that would allow for drawdown of capital. We will have to adjust our risk profile as time goes on but in 10 years from now we will also have access to a portion of retirement funding (which makes up 15% of the portfolio at the moment) at which time we can re-evaluate. Until then we’ll probably make yearly lump sum contributions to regulated retirement products to reduce our taxable income. All investments are currently equally spread between us and all assets registered in both our names for the most efficient tax structure.

What was the hardest part of all the savings you made? Did you need to cut back on a lot of things or miss out on many things the regular spenders had?

I don’t personally feel like we’re missing out but accept that we’re not all satisfied equally by the same things in life. What’s important for me may not be for you and vice versa. It’s hard not to come across as smug when you know who will have the last laugh as I would much rather contain my urge for indiscriminate spending in exchange for life long financial independence at an age young enough to enjoy the freedom it brings. More than the idea of “missing out” one has to learn to cope with societal pressures where appearances somehow still matter. You have to remind yourself that a flashy car or designer clothing definitely does not mean that someone is financially independent – in fact more often than not it’s the complete opposite.

Speaking about cars, what do you drive?

I generally avoid talking about vehicles as to me it’s mostly utilitarian whereas some can be rather passionate about it. As a hobby I do enjoy off-road enduro but for the most of it a vehicle is a begrudging necessity. I do acknowledge that one cannot always base your choice on what to drive purely on a financial calculation and that heart and emotion can play a factor as well. However, this is a hurdle most people stumble at, as it’s too easy to justify the cost of a car payment without fully comprehending the total cost of ownership or the potential loss of opportunity that goes along with it. Some friends take jibes at me to “live a little” and scoff at my choice of vehicles but once again I’m content in the knowledge that my decisions contributed to financial independence and early retirement. But if you MUST know what I drive I have a 16 year old Toyota Hilux (which I bought 10 years ago and rarely take out of the garage as it’s crazy heavy on fuel) but I still love it for the odd trip to the Namib desert or Karoo and it seems to holds its value reasonably well. I also have two motorbikes – a 2002 model Triumph, which we use for road tripping, and a 20 year old Honda scrambler which I ride around town and to the office and back. It’s important however, that we have at least one newer car in the household as my wife drives around for work quite a bit – reliability and running cost are important factors. Last year we thus bought a demo model 2016 Suzuki Vitara (with extended warranty and service plan until 2021) in my wife’s company’s name by way of a loan from ourselves.

Why do you think most people can’t do what you’ve done?

This is a tough one without a straight-forward answer as life can deal some people a bad hand. However, it’s also all too easy to make excuses, blame circumstance or other people for your poor choices. Of course we do not all have the same opportunities in life but at least be smart about the choices you make and take responsibility for your own future.

What do you like to spend money on?

That’s easy! The only thing worth spending money on is life enriching experiences. Travelling is the purest form of this. We don’t live like paupers at all but we’re far from what would be considered wealthy to the average observer. Even though we regularly go on fairly long holidays our expenditure is probably a lot less than what anyone might think.

How do you spend your time outside of work?

In summer we tend to spend weekends near the ocean as we both kitesurf. We definitely enjoy adventurous activities and have over the years tried our hand at anything imaginable from scuba to skydiving to climbing Kili. We also enjoy touring by motorcycle to escape the bustle of the urban life whenever possible.

Do you have any advice for the many people who are most likely very inspired by what you’ve achieved?

Start saving early. Do not underestimate the power of compound interest. Make smart lifestyle choices and live well within your means. Pool your household income to maximise investment power. Work out a budget and savings regime and stick to it. Eliminate the small leaks in your savings like too many or costly bank accounts and gadgets you don’t need. Save and buy cash as it gives you an appreciation for your earnings and your assets. Calculate total cost of ownership before you finance anything as well as calculate the loss of opportunity incurred by financing.

Make sure you understand the impact of inflation. As an example: We were chatting the other day as to the risks of investing in the stock market and the comment was made “luckily I purchased Kruger Rands 10 years ago and it has almost doubled in value since”. Great I said, just like that house I bought 10 years ago that has doubled in value (it hasn’t actually) – sadly both are still worth exactly the same today in real terms once you account for inflation. To rub salt in the wounds SARS doesn’t care much for inflation and still want their cut of your capital gains. If an asset doubles in value over 10 years and you are taxed on the proceeds you can be as much as 10% worse off than when you started. Sobering thought.

If you were beamed back to the beginning of your working career, would you do anything different this time around?

I probably would have avoided insurance style investment policies / annuities and paid closer attention to fees and the effect it has on savings. There’s no such thing as starting to invest too early.

Do you have a blog/facebook page/twitter account/instagram/youtube channel that people can follow your future adventures on?

For sure! I quite like making the odd vlog style travel video and slowly but surely will get better at it! It’s just for fun though but I’m hoping to upload regular videos once we start wrapping things up and start travelling. You can find us on YouTube here: https://goo.gl/55TQvR. Else find me on Instagram here: https://goo.gl/6SrzAs

Is there a question (or questions) you think I should have asked? Let me know and answer it please!

Gosh I think most is in here somewhere. Not sure if you want more on investment strategy while travelling or tax implications? Or perhaps more on dealing with money while travelling and how to access it. Let me know.

Thanks for making such an effort Andre, it’s truly inspiring what you have achieved. If you readers have any questions post them in the comments below and hopefully Andre or Lisa can take some time out of their awesome lives to answer them.

Now for some more pictures!