Dear Investor Challenge,

I’m 22 and I just started adulting, doing a 9 to 5 as a PR specialist. I guess nowadays that means I know how to use Facebook and Twitter to create fake news so my clients look innocent while they loot and plunder. Now I’m a millennial and that means I live entirely on Chai soy lattes and avocado toast. It also means that I want to have a proper work-life balance, which is why I was so thrilled to read your last blog post.

Really, that stuff was lit, I can’t believe it didn’t break the internet, you’re so woke! I’d love to work only half the time so I can finally have time to take care of all the stuff that gives me FOMO, and sharing jobs is just as brilliant. The world would be a better place if the people who wanted to work could. I’m more than happy to share mine with someone else, more time for me to bounce for some #VanLife with my bae and my Labradoodle Frodo, and a salary for some other he or she so they can buy a van too, win-win!

The problem is my boss is such a boomer. When I told her she was all sus and said I’d never get anywhere in life if I thought like that. She even said I’d never be able to afford a house or send my kids to private school. I think she’s just jealous because she’s under a truckload of debt just to afford her boring McMansion and an expensive horse habit. I can’t even.

Now since I quite like getting paid to troll people on Twitter, is there anyway I could still make this 50% working time thing work for me?

Jed Dye

I know what you mean Jed, the struggle is real. But don’t get your man-bun in a knot over your boomer boss, because if you’ve been reading my blog, you’ll know I always have a way out of these problems. Just like you, I also work in a place that thinks people need to be at their desks 5 days a week.

They also have this weird notion that people spend their all their time at work, at work, but since I get to see what the Internet logs look like, all I can assume is that everyone I work with has a PR side gig at least half the time! If management was smart they’d make them stay home 50% of the time and cut their salary by 50% while expecting them to do the same amount of work.

But let’s just face up to it, the world isn’t going to change according to our timelines. Don’t worry though, because I have a 50% working scheme that doesn’t require management’s approval. I’m fact, there’s no way management could stop this scheme even if they wanted to. I know this because it’s the 50% working plan I’ve been on since I first started working, and thanks to that I could put it into practice myself right now if I wanted to. Humble brag. Sorry not sorry.

You see a typical lifetime follows the 20-40-20 system. You grow up and educate yourself for 20 years, then you work for 40 years before retiring and spending all that hard-earned cash for the last 20 years by going golfing, sailing and travelling the world. At least that’s the dream we get fed by our schools, universities and financial advisers throughout life.

In reality, the average person spends 17 years getting educated, 3/4/5 years recovering from a tertiary hangover, then we work for 40 years in a potentially monotonous or soul-sucking job. Then we work another 5 years because we’re still poor until we’re forced to retire. After that, we stay home because we’re either too old for adventures or because we’ve made our financial advisors rich rather than ourselves. Then we die a just few years later.

So how about we turn the system on its head by changing from a 20-40-20 life to a 20-20-40. Grow and study for 20ish years, then work for just another 20, and hang up the chinos and ties for the rest of our lives after that so we can go on those adventures before we’re old enough to hide our own Easter eggs.

So how do we do that?

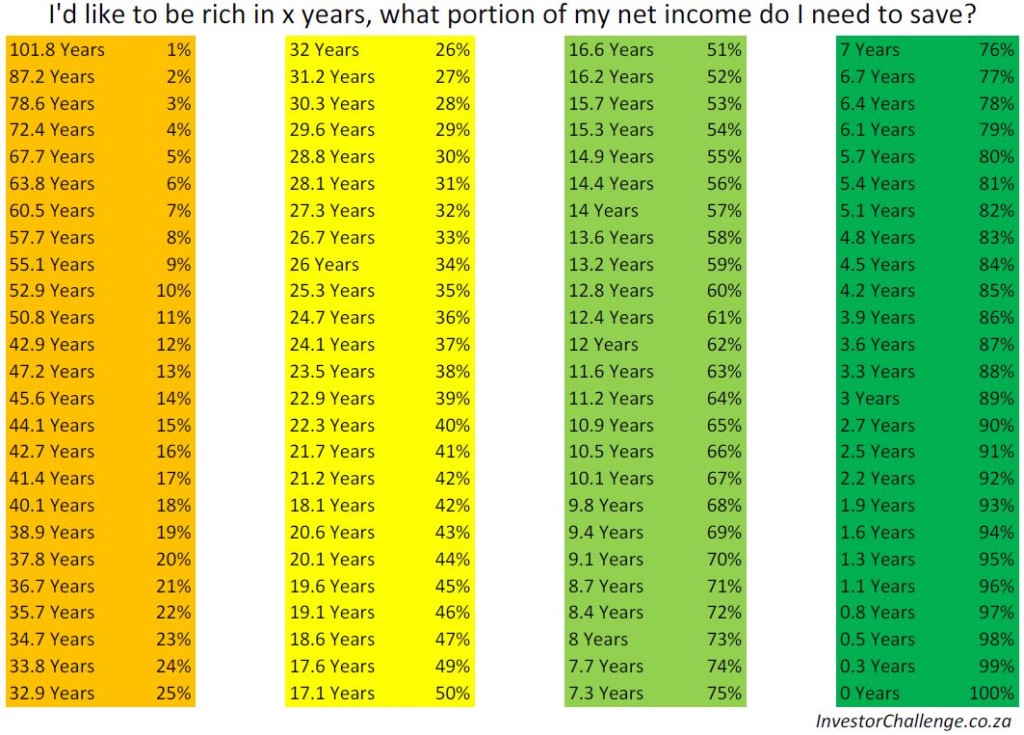

It’s quite simple actually. Do you remember that chart I posted way back when I started blogging 7 years ago in 2013? Yeah, I’m feeling old all of a sudden! Anyway here’s the chart:

As you can see, all you have to do to cut your working career from 45+ years to 20 years is to save and invest 44% of your income. Then after 20 years your investments will be worth 300 times your monthly spending. That’s usually more than enough for you to keep living as you’re living, in fact the most likely outcome is you’ll die having much more money than the day you retired.

Sadly one thing has changed quite significantly in South Africa since 2013. The government stole all our money and then upped taxes, so while it would have been 44%, it’s actually now 46.4% that’s needed. Not a huge change, and it still gives you more to spend than you need to save.

Since you never told me how much you earn, I had to go and find some info for the average PR specialist. Happily, there’s now a website called Payscale.com which has figures for most careers in most countries. This is what it says for you. It probably also makes you wish you studied to be a CA or even an IT guy like me.

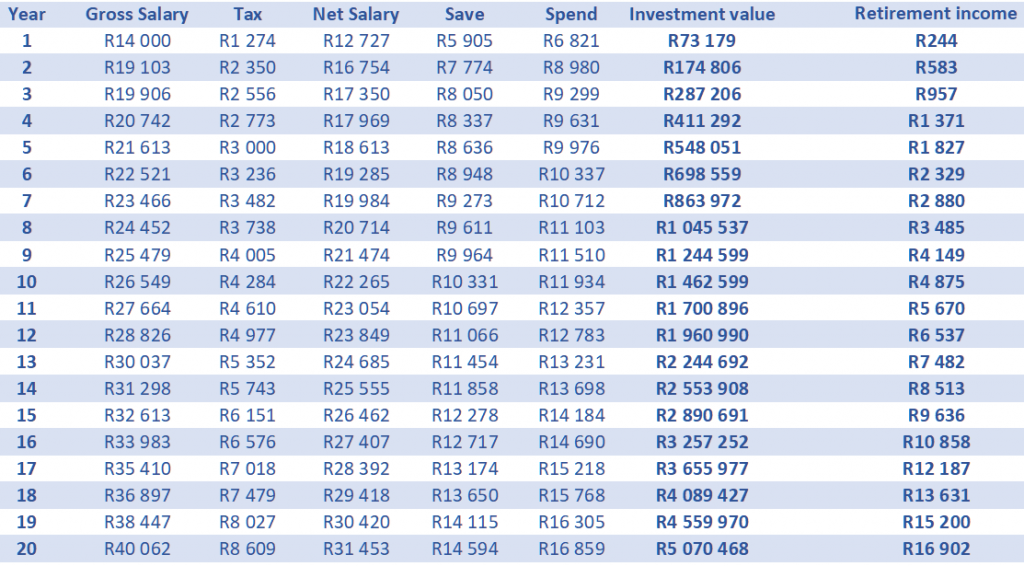

But no, instead you decided to run a Twitter army so you’ll have to live with the pay you’ve got. I took the curve on the Payscale chart and figured out that your salary would increase by 4.2% in real terms. Now there’s no figure for starting out, so I’m going to suck a number out of the air with no care at all for accuracy and say you started on R14 000 a month, but gave you a big jump after 1 year as is often the way these things work.

Here’s how it looks in practice:

As I said real terms above, that means I’ve decided to cancel out inflation by not increasing your salary or investment growth by inflation, just real growth. It’s easier than doing the inflation calculations and trying to work back to see what the numbers would be like in today’s money. So for your investments you’re growing by a reasonably average figure of 7% per year.

And that’s all that’s needed to get to a R5 million investment account when you’re just 42 years old. And that’s a real R5 mil, as if it was in your bank account today.

Now to many people the amount you get to spend every month seems very low, particularly in the early years but since you’ve only just started working you know it’s possible to live on less than R7k a month. The key is to avoid lifestyle inflation. There’s no reason why you need to have your own place and a fancy car just because you’re working. Share a place, humans are social creatures, it’s one of the reasons we get married, and if you’re too far to cycle to work, get a scooter, millions of people all over the world use them for transport, but strangely few in South Africa.

There are a bunch of really good reasons for you to try this:

- If you retire sooner, you live longer! This article quotes a study that says it’s much longer in fact. Those retiring before 55 live into their 70’s or 80’s. Sadly those retiring after 65 never even lived another 2 years. It kind of makes sense, if you retire younger you’re more likely to get more exercise and learn new things. You also have the time to cook decent food and avoid fast food.

- You’re ready for the mid-life crises. These things are real. Now that I’m 41 I can actually feel it building. My wife feels it too. There’s a very strong desire to break out of our routines. We debate selling up everything and going sailing for a few years, or cycling across Europe, or taking a campervan from Alaska to the southern tip of South America. The only reason we haven’t is the kid in school and the jobs we’re actually really enjoying. Oh and the lockdown.

- Speaking of which, when you’re on the 20-year plan and things go badly wrong, you don’t end up losing your house or car, you have a huge amount of resources to pull from to keep you going. It might just add a year or two to your plan. Those businesses that can survive this lockdown are going to end up with far less competition, so they’re likely going to do even better in future, just like Bubba-Gump Shrimp.

- You get to experience the JOMO (joy of missing out) of bad times at work because you have F-You money.

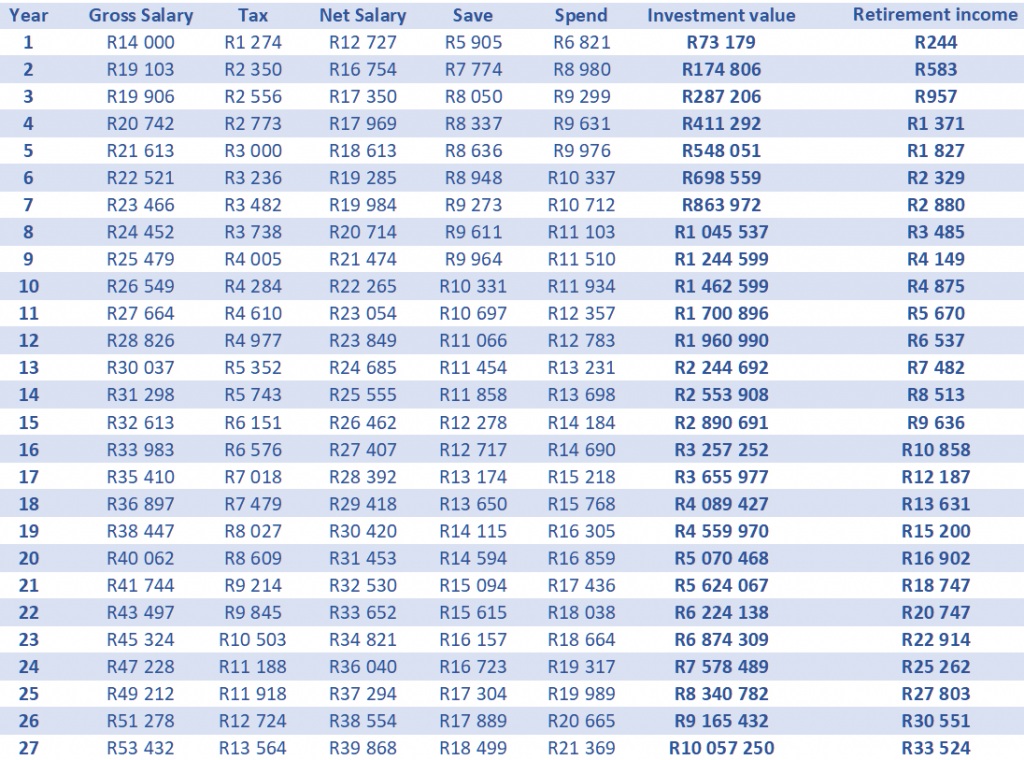

- You have the option of being really wealthy. While it took you 20 years to get to R5 million, if you’d like to live a much more luxurious life all you need to do is work another 7 years and you get to retire at 49 with R10 million:

If you’re interested, it would take you 32 years to get to R15 million, 35 years for R20 million, 38 years for R25 million and 40 years for R30 million. But I’d be willing to bet that you wouldn’t end up on your death bed one day saying if only I’d worked a little longer, I could be dying in a more expensive house…